Policies And Procedures

Satisfactory Academic Progress Policy

SATISFACTORY ACADEMIC PROGRESS POLICY

The Satisfactory Academic Progress Policy is consistently applied to all students enrolled in a specific NACCAS approved program and scheduled for a particular category of attendance at the school. It is printed in the catalog to ensure that all students receive a copy prior to enrollment. The policy complies with the guidelines established by the National Accrediting Commission of Career Arts and Sciences (NACCAS) and the federal regulations established by the United States Department of Education.

MINIMUM SAP REQUIREMENTS

Minimum satisfactory academic progress shall be determined by a cumulative grade average of theory and practical grades of no less than 75% and a 67% attendance rate.

EVALUATION PERIODS

Students are evaluated for Satisfactory Academic Progress at the completion of the following evaluations periods to determine if the student has met the minimum requirements.:

*Transfer Students- Midpoint of the contracted hours or the established evaluation periods, whichever comes first.

If the student is not meeting the requirements, he/she/they will be notified in writing by the Faculty & Education Coordinator. Students who meet the SAP requirements will not be notified but may view their SAP status on the Student SMARTFLEX portal or request a copy form student service.

For all programs, the institution follows a 900-clock hour, 30-week academic year. All evaluations will be completed within seven (7) school business days following each established evaluation period. Evaluations are done based on actual completed hours.

ATTENDANCE PROGRESS

Students are required to attend a minimum of 67% of the hours possible based on the applicable attendance schedule to be considered maintaining satisfactory attendance progress. Evaluations are conducted at the end of each evaluation period to determine if the student has met the minimum requirements. The attendance percentage is determined by dividing the total hours accrued by the total number of hours scheduled. At the end of each evaluation period, the school will determine if the student has maintained at least 67% cumulative attendance since the beginning of the course which indicates that, given the same attendance rate, the student will graduate within the maximum time frame allowed.

MAXIMUM TIME FRAME

The maximum time (which does not exceed 150% of the course length) allowed for students to complete each course at satisfactory academic progress is stated below:

| Programs | Clock hours | Full Time Weeks | Part time Weeks |

| Esthetics | 900 | 33 | 57 |

| Master Esthetics | 900 | 33 | 57 |

| Nail Technician | 225 | n/a | 22.5 |

| Permanent Cosmetics | 300 | n/a | 20 |

| Wax Technician | 172.5 | 6 | 11 |

The maximum time allowed for transfer students who need less than the full course requirements or part-time students will be determined based on 67% of the scheduled contracted hours.

Students who have not completed the course within the maximum timeframe will be terminated from the program.

ACADEMIC PROGRESS

The qualitative element used to determine academic progress is a reasonable system of grades as determined by assigned academic learning. Students are assigned academic learning and a minimum number of practical experiences. Academic learning is evaluated after each unit of study. Practical assignments are evaluated as completed and counted toward course completion only when rated as satisfactory or better. If the performance does not meet satisfactory requirements, it is not counted, and the performance must be repeated. Practical skills are evaluated according to State CIB procedures and set forth in practical skills evaluation criteria adopted by the school. Students must maintain a written grade average of 75% and pass a FINAL written and practical exam prior to graduation. Students must make up for failed or missed tests and incomplete assignments. Numerical grades are considered according to the following scale:

90 – 100 EXCELLENT 75 – 79 SATISFACTORY

80 – 89 VERY GOOD 74 and BELOW UNSATISFACTORY

DETERMINATION OF PROGRESS STATUS

Students meeting the minimum requirements for academics and attendance at the evaluation point are considered to be making satisfactory academic progress until the next scheduled evaluation. Students not meeting SAP will receive a hard copy of their Satisfactory Academic Progress Determination at the time of the evaluation in writing or via email. . Students deemed not maintaining Satisfactory Academic Progress may have their Title IV Funding interrupted, unless the student has prevailed upon appeal resulting in a status of probation. Lack of attendance may also affect student’s VA benefits as the law requires that educational assistance benefits to Veterans and other eligible persons be discontinued when the student ceases to make satisfactory progress toward completion of his or her training objective. Benefits can however be resumed if the student reenrolls in the same educational institution and in the same program.

PROBATION

Students who fail to meet minimum requirements for attendance or academic progress after the warning period will be placed on probation and considered to be making satisfactory academic progress while during the probationary period, if the student appeals the decision, and prevails upon appeal. Additionally, only students who have the ability to meet the Satisfactory Academic Progress Policy standards by the end of the evaluation period may be placed on probation. Students placed on an academic plan must be able to meet requirements set forth in the academic plan by the end of the next evaluation period. Students who are progressing according to their specific academic plan will be considered making Satisfactory Academic Progress. The student will be advised in writing of the actions required to attain satisfactory academic progress by the next evaluation. If at the end of the probationary period, the student has still not met both the attendance and academic requirements required for satisfactory academic progress or by the academic plan, he/she will be determined as NOT making satisfactory academic progress and, if applicable, students will not be deemed eligible to receive Title IV funds.

RE-ESTABLISHMENT OF SATISFACTORY ACADEMIC PROGRESS

Students may re-establish satisfactory academic progress and Title IV aid, as applicable, by meeting minimum attendance and academic requirements by the end of the probationary period.

INTERRUPTIONS, COURSE INCOMPLETES, WITHDRAWALS

If enrollment is temporarily interrupted for a Leave of Absence, the student will return to school in the same progress status as prior to the leave of absence. Hours elapsed during a leave of absence will extend the student’s contract period and maximum time frame by the same number of days taken in the leave of absence and will not be included in the student’s cumulative attendance percentage calculation. Students who withdraw prior to completion of the course and wish to re-enroll will return in the same satisfactory academic progress status as at the time of withdrawal.

APPEAL PROCEDURE

If a student is determined to not be making satisfactory academic progress, the student may appeal the determination within ten calendar days. Reasons for which students may appeal a negative progress determination include death of a relative, an injury or illness of the student, or any other allowable special or mitigating circumstance. The student must submit a written appeal to the school on the designated form describing why they failed to meet satisfactory academic progress standards, along with supporting documentation of the reasons why the determination should be reversed. This information should include what has changed about the student’s situation that will allow them to achieve Satisfactory Academic Progress by the next evaluation point. Appeal documents will be reviewed and a decision will be made and reported to the student within 30 calendar days. The appeal and decision documents will be retained in the student file. If the student prevails upon appeal, the satisfactory academic progress determination will be reversed and federal financial aid will be reinstated, if applicable.

REPETITIONS AND NON-CREDIT REMEDIAL COURSES

Noncredit, remedial courses, and repetitions do not apply to this institution. Therefore, these items have no effect upon the school’s satisfactory academic progress standards.

TRANSFER HOURS

Regarding Satisfactory Academic Progress, a student’s transfer hours will be counted as both attempted and earned hours for the purpose of determining when the allowable maximum time frame has been exhausted.

Student Conduct Policy and DISCIPLINE

The Esthetic Institute strives to develop professionalism in our students/graduates and to prepare them for the expectations of the salons, spas, and other professional places of business that will hire our graduates. As such please understand the standards below:

- Students are expected to attend classes as scheduled each day. If a student is unable to attend school on any day, he/she/they shall notify the Instructor/School Administrator in order for proper arrangements to be made with teachers and clients. The first crucial step in professionalism is consistent attendance. As a professional in the beauty industry your employers will expect to be able to count on your consistent attendance on the assigned days; The Esthetic Institute has the same expectation. Therefore, students are expected to consistently attend as scheduled. (see Attendance Policy for more detail.)

- Students may not refuse to perform client services or daily sanitation/clean up assignments as these tasks are part of the training.

- Only topics of ethical, moral, and professional subject matter should be discussed on the school premises. Unprofessional language, profanity, inappropriate slang, spreading rumors or gossiping should be avoided. Cursing will not be tolerated. Such behavior will result in appropriate disciplinary action including, but not limited to suspension.

- Conflicts of any nature with another student, staff member or client are not permitted on school premises. Actions or threats that could cause bodily harm or threaten the life of any client, student or staff member of the school are not permitted. Insubordination (defiance of authority) is not permitted. Criticism of staff, clients or other students is not permitted on school premises. Any student having a suggestion, complaint or concern should register it with the School Administrator rather than with other students or clients. Students are expected to avoid disrupting the learning environment or the education of other students.

CONDUCT AND DISCIPLINE

The following statements define those behaviors that are not in harmony with the educational goals of the school:

- Academic dishonesty, such as cheating, or knowingly furnishing false information.

- Forgery, alteration, misuse or mutation of school documents, records, identifications, educational materials, or property.

- Obstruction or disruption of teaching, administration, or other school activities.

Theft, or damage to, property of school, property used by school, or using or attempting to use school property in a manner inconsistent with its designed purpose. - Unauthorized entry, use or occupation of school facilities.

- Intentional and unauthorized interference with right of access to school facilities or freedom of movement or speech of any person or premises.

- Use or possession of firearms, ammunition or other dangerous weapons, substances, or materials prohibited by law.

- Disorderly conduct or lewd, indecent, or obscene conduct or expression.

- Rioting or participating in a riot.

Failure to comply with the verbal or written directions of any school official acting in the performance of his/her duty and in scope of his/her performance. - Removing or misplacing school property.

- Aiding or inciting others to commit any act of misconduct set forth in the above.

*If a student is found in violation, he/she/they may be subject to any of the following:

- Reprimand

- Specific restrictions may be imposed.

- Disciplinary probation and further infractions within the probation time may result in suspension.

- Termination.

**After being suspended a student may be readmitted at the discretion of the school and only after the Dean approves a written request. Re-admission will be on a probationary basis. Any further violation will result in immediate termination.

TERMINATION

The refund policy applies to all terminations for any reason. The school may immediately terminate a student’s enrollment for noncompliance with General Policies; the signed enrollment contract; State Laws and regulations; Improper conduct; Any negative/disrespectful comments; Behavior that is considered disruptive or any actions which could cause bodily harm to a client, a student, or employee of the school, injury to the school’s reputation ; willful destruction of school property; theft/any illegal act. . If a student maintains unsatisfactory grades or academic progress, he or she may be dismissed from the program.

Return And Cancellation Policies

The following policy will apply to all terminations for any reason, by either party, including student decision, expulsion, course or program cancellation, or school closure.

- An applicant not accepted by the school shall be entitled to a refund of all monies paid less a non-refundable application fee of $100.00 for all courses offered.

- If a student or legal guardian cancels his/her contract and demands his/her money back in writing, within three (3) business days of the signing of the enrollment agreement, all tuition collected by the school shall be refunded except the non- refundable application fee of $100.00. The cancellation date will be determined by the date said information is postmarked or delivered to the school administrator in person. These policies apply regardless of whether or not the student has actually started training.

- If a student cancels his/her contract after three business days of signing the enrollment agreement, but prior to entering classes, he/she shall be entitled to a refund of all monies paid to the school less a non-refundable application fee of $100.00 for all courses offered.

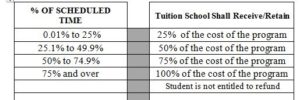

- For students who enroll in and begin classes, the following schedule of tuition adjustment will be authorized:

- “Scheduled Time” is defined as the hours scheduled to attend between the actual starting date and the last date of physical attendance. Clock hours are recorded and monitored by the Biometric Attendance system.

- The refund policy will apply to tuition and fees charged in the enrollment agreement.

- All charges to the student for books, kit items, products, etc., or debts to the school incurred by the student will be calculated separately at the time of withdrawal. The student is responsible for 100% of the charges for those items; these items become the property of the student when issued and are not included in any tuition adjustment computations. The school shall adopt and adhere to reasonable policies regarding the handling of these expenses when calculating the refund.

- Any tuition due to the applicant or student shall be refunded within 45 days of formal cancellation by the student or formal termination by the school, which shall occur no more than 14 calendar days from the last day of physical attendance, or in the case of a leave of absence, the earlier of the scheduled date of return or the date that the student notifies the school that he/she will not be returning.

- If the school is permanently closed or is no longer offering instruction after a student has enrolled, the school will make a Pro Rata refund of tuition for each student. NACCAS will be provided a list of all students enrolled at the time of closure and the amount of each Pro Rata refund. The school shall dispose of all school records in accordance with state laws.

- When situations of mitigating circumstances are in evidence, the school may make a settlement which is reasonable and fair to the student and the school.

- If the course is cancelled subsequent to a student’s enrollment and before instruction in the course has begun, the school will provide either a refund of all monies paid or accommodate the completion of the course at a later date. The school reserves the right to reschedule, postpone, or cancel classes.Any return of Title IV funds will be paid as applicable, 1) Unsubsidized Federal Direct Loan, 2) Subsidized Federal Direct Loan, 3) Federal PLUS/Direct PLUS Loan, 4) Federal Pell Grant, 5) Federal SEOG, 6) Other Federal, state, private or institutional aid, 7) the student. If the student has received personal payments of Title IV aid, he/she may be required to refund the aid to the applicable program.Students attending the institution who withdraw or terminate prior to course completion and who are recipients of Title IV funds shall be evaluated for a return of Title IV funds according to federal guidelines.

Return Of Title IV Funds

The law specifies how your school must determine the amount of Title IV program assistance that you earn if you withdraw from school. The Title IV programs available at Esthetic Institute that are covered by this law are: Federal Pell Grants Federal Direct Stafford Loans (Subsidized and Unsubsidized) Federal Direct PLUS Loans. When you withdraw during your payment period the amount of Title IV program assistance that you have earned up to that point is determined by a specific formula. If you received (or your school or parent received on your behalf) less assistance than the amount that you earned, you may be able to receive those additional funds. If you received more assistance than you earned, the excess funds must be returned by the school and/or you. The amount of assistance that you have earned is determined on a pro-rata basis. For example, if you completed 30% of the scheduled hours in your payment period, you earn 30% of the assistance you were originally scheduled to receive. Once you have completed more than 60% of the scheduled hours in your payment period, you earn all the assistance that you were scheduled to receive for that period. If you did not receive all of the funds that you earned, you may be due a Post-withdrawal disbursement. If your Post-withdrawal disbursement includes loan funds, your school must get your permission before it can disburse them. You may choose to decline some or all of the loan funds so that you don’t incur additional debt. Your school may automatically use all or a portion of your Post-withdrawal disbursement of grant funds for tuition, fees, and room and board charges (as contracted with the school). The school needs your permission to use the Post-withdrawal grant disbursement for all other school charges. If you do not give your permission (some schools ask for this when you enroll), you will be offered the funds. However, it may be in your best interest to allow the school to keep the funds to reduce your debt at the school. There are some Title IV funds that you were scheduled to receive that cannot be disbursed to you once you withdraw because of other eligibility requirements. For example, if you are a first-time, first-year undergraduate student and you have not completed the first 30 days of your program before you withdraw, you will not receive any Direct loan funds that you would have received had you remained enrolled past the 30th day. If you receive (or your school or parent received on your behalf) excess Title IV program funds that must be returned, your school must return a portion of the excess equal to the lesser of: your institutional charges multiplied by the unearned percentage of your funds, or the entire amount of excess funds. The school must return this amount even if it didn’t keep this amount of your Title IV program funds.

Initial Amount of Unearned Title IV Aid due From the Student

The statute specifies that a student is responsible for all unearned Title IV program assistance that the school is not required to return. In Step 7 of the R2T4 calculation worksheet the initial amount of unearned federal student aid due from the student (or parent, for Direct PLUS Loan funds) (Box Q) is determined by subtracting the amount returned by the school (Box O) from the total amount of unearned Title IV funds to be returned (Box K). This is called the initial amount due from the student because a student does not have to return the full amount of any grant repayment due. Therefore, the student may not have to return the full initial amount due.

Repayment of Student Loans

The student loans that remain outstanding in (Box R) of Step 8 of the R2T4 calculation worksheet consist of the loans disbursed to the student (Box B) minus any loans the school repaid in Step 6, Block P. These outstanding loans are to be repaid by the student according to the terms of the student’s promissory notes. Title IV Grant Funds to Be Returned By a Student The regulations limit the amount a student must repay to the amount by which the original overpayment amount exceeds 50% of the total grant funds disbursed or could have been disbursed by the student for the payment period or period of enrollment. The initial amount of unearned Title IV grant aid due from the student in step 9 (Box S) of the R2T4 calculation worksheet is found by subtracting the loans to be repaid by the student (Box R) from the initial amount of unearned aid due from the student (Box Q). The amount of grant overpayment due from a student is limited to the amount by which the original grant overpayment (Box S) exceeds half of the total Title IV grant funds disbursed and could have been disbursed to the student in (Box F).

Return of Title IV Grant Funds by the Student

The student is obligated to return any Title IV overpayment in the same order that is required for schools. Grant overpayments may be resolved through:full and immediate repayment to the school;repayment arrangements that are satisfactory to the school;or by overpayment collection procedures negotiated with Debt Resolution Services.

A School’s Responsibilities in The Return of Funds by the Student

A school has responsibilities that continue beyond completing the Return calculation and returning the funds for which it is responsible. Here we discuss the institution’s participation in the return of funds by the student.

Grant Overpayments

The applicable regulations limit the amount of grant funds a student must repay to one-half of the grant funds the student received or could have received during the applicable period. Moreover, repayment terms for students who owe Title IV grant overpayments were established to ensure that students who could not immediately repay their debt in full had the opportunity to continue their eligibility for Title IV funds. Students who owe overpayments as a result of withdrawals initially will retain their eligibility for Title IV funds for a maximum of 45 days from the earlier of the date the school sends the student notice of the overpayment, or the date the school was required to notify the student of the overpayment. Within 30 days of determining that a student who withdrew must repay all or part of a Title IV grant, the school will notify the student in writing via U.S mail that he or she must repay the overpayment or make satisfactory arrangements to repay it. In its notification, the school will inform the student of the following five items: The student owes an overpayment of Title IV funds. The student’s eligibility for additional Title IV funds will end if the student fails to take positive action by the 45th day following the date the school sent or was required to send notification to the student.

Order of Return of Title IV Funds

The school and or the student if applicable must return Title IV funds to the programs from which the student received aid during the payment period or period of enrollment as applicable, in the following order, up to the net amount disbursed from each source: Unsubsidized Direct Stafford loans (other than PLUS loans). Subsidized Direct Stafford loans. Direct PLUS loans. Federal Pell Grants for which a return of funds is required. There are three positive actions a student can take to extend his or her eligibility for Title IV funds beyond 45 days: The student may repay the overpayment in full to the school. The student may sign a repayment agreement with the school. Note: Two years is the maximum time a school may allow for repayment. The student may sign a repayment agreement with the Department. *****The student should contact the school to discuss his or her options*****

Consequences for Not Following upon the Notification

If the student takes no positive action during the 45-day period, the school will report the overpayment within a few days of the end of the 45-day period to NSLDS on the NSLDS Professional Access Web site under the AID tab, “Overpayment List” menu option after the 45-day period has elapsed. If the student fails to take one of the positive actions during the 45-day period, the student’s overpayment will be reported immediately to the NSLDS and referred to the Debt Resolution Services for collection. When a student receives additional funds during the 45-day period of extended eligibility: Students who owe overpayments as a result of withdrawals generally will retain their eligibility for Title IV funds for a maximum of 45 days from the earlier of (a) the date the school sends the student notice of the overpayment, or (b) the date the school was required to notify the student of the overpayment. A student who receives Title IV funds within that period of extended eligibility and then fails to return the overpayment or make repayment arrangements becomes ineligible for additional Title IV program funds on the day following the 45-day period. However, any Title IV program funds received by the student during the 45-day period were received while the student was eligible. Therefore, those Title IV funds do not have to be returned (unless the student withdraws a second time). A student who loses his or her eligibility for Title IV funds at the expiration of the 45-day period will remain ineligible for additional Title IV funds until the student enters into a repayment agreement with the Department. If, at any time, a student who previously negotiated a repayment arrangement fails to comply with the terms of his or her agreement to repay, that student immediately becomes ineligible for additional Title IV funds. The school will also notify the student in writing via U.S. mail using a Refund Calculation worksheet, of the amounts of aid that were retained by the school for institutional charges and the amount(s) of aid that will be refunded by the school to each Title IV program. The student will also be notified of the amount of Title IV loans they will owe after all applicable refunds have been made, the requirement for the student to complete exit counseling, when the student will be responsible to start repayment of their student loans and who they may contact for further assistance or to report any changes to their personal information. The requirements for Title IV program funds when you withdraw are separate from any Institutional Refund Policy that your school may have. Therefore, you may still owe funds to the school to cover unpaid institutional charges. Your school may also charge you for any Title IV program funds that the school was required to return. If you have questions about your Title IV program funds, you can call the Federal Student Aid Information Center at 1-800-4-FEDAID (1-800-433-3243). TTY users may call 1-800-730-8913. Information is also available on Student Aid on the Web at www.studentaid.ed.gov.

Return To Title IV Example

On March 19, 2014 Mary has been absent for 14 consecutive calendar days without notification to the school. Her school director determines at this point that Mary needs to be terminated from her program for non-attendance. Her last day of attendance was March 5 and as of this day Mary had 250 scheduled hours available to her to attend school. Even though she may only have actually attended 150 hours she was scheduled for 250 and this is the number of hours that will be used for the Return to Title IV calculation.

The school charges the total tuition, books kit and fees for the program up front. At her school the total cost of the program is $13,750.00 (Tuition: $12,750.00, Books and Kit: $790.00, Uniforms $90.00, Student Permit Fee: $20.00 and Registration Fee: $100.00) The school has received the first disbursements of a Pell Grant in the amount of $2,865, a Subsidized Direct Loan for $1,732.00 and an Unsubsidized Direct Loan for $2,969.00 for the first 450 hours towards Mary’s tuition, kit, books and fees for a total of $7,566.00. Since the percentage allowed to be retained is calculated by dividing the scheduled hours completed in the current payment period by the scheduled hours available in the payment period as of the official withdrawal date or last date of attendance, the school takes the 250 scheduled hours in the payment period as of the last date of attendance divided by the 450 scheduled hours in the entire payment period which equals .556%. This is the percentage of the total amount of aid received that can be retained ($7,566.00 X .556 = $4,206.70) In the event that the scheduled hours completed in the payment period had been greater than 60% of the 450 scheduled hours for the payment period, then the total amount received could have been retained however it was not and so only the prorated amount of $4,206.70 could be retained. This leaves a balance of $3,359.30 which must be returned or refunded to the FSA programs.

The school will now go through a process of determining how much of the $3,359.30 must be returned by the school and how much the student is responsible for. For this they will need to determine the greater of the two amounts of: a) the prorated amount of all institutional charges or: b) the amount the school retained to pay allowable institutional charges for the current payment period. First the school will take the total contracted amount for tuition, books, kit and fees which equals $13,750.00 and divide it by the hours in the program to determine an hourly prorated amount ($13,750.00/1500=$9.17) Now it will multiply the hourly proration X the 450 hours in the payment period which =$4126.50 rounded up to $4127.00 The greater of the two is the amount of Title IV that was retained for the payment period ($7,566.00). This is the amount that will be used as total institutional charges in Step 5 of the R2T4 calculation. This amount will then be multiplied by the.444 % of unearned Title IV aid. In this case study the entire amount of unearned aid ($3,359.30) must be refunded by the school and the student is not obligated to do anything except to pay back the remaining loan amounts after all refunds have been made.

Again, keep in mind that the school will also calculate their Institutional Refund Policy to determine how much they are entitled to charge the student for the time they were in school. This is a separate calculation and it may be determined that the Title IV retainable is not sufficient to cover the school’s charges and consequently the student may still owe the school an additional sum of money which will need to be paid in addition to the Title IV Funds.

Determination Date - Withdrawal Date

The actual last date of attendance would be the last day the student was physically in attendance. A withdrawal date on a student who had been previously attending could be up to, but not to exceed 14 calendar days from that student’s actual last date of attendance. An active student officially withdraws when they notify the school’s administrative office of their intention to withdraw from school in writing. An active student is considered unofficially withdrawn when they have been absent for 14 consecutive school days from their last date of physical attendance without notifying the school’s administrative office.

Re-enrollment after Termination/Withdrawal

At Esthetic Institute, we believe in fostering a positive and harmonious environment for our students. That’s why we have a strict policy when it comes to re-enrollment. We will not re-enroll any student who has been terminated from our program or who has demonstrated disharmony with our purpose, objectives, standards, policies, rules, and regulations. Additionally, we require all financial obligations from the previous school year to be met before a student can be readmitted. Our goal is to admit students who are likely to thrive and succeed in our programs.

Leave Of Absence Policy

LEAVE OF ABSENCE POLICY

A Leave of Absence (LOA) is a temporary interruption in a student’s program of study. LOA refers to the specific time period during an ongoing program when a student is not in academic attendance. The school may allow more than one LOA at its discretion. Students must request a Leave of Absence in advance unless unforeseen circumstances prevent the student from doing so, and that:

- The request must be in writing

- The request must include the student’s reason for the LOA; and

- The request must include the student signature

The reasons for which a leave of absence may be approved include:

- Personal and/or family medical issues

- Death in the family

- Other mitigating circumstances

The institution may grant an LOA to a student who did not provide the request prior to the LOA due to unforeseen circumstances if:

- The institution documents the reason for its decision

- The institution collects the request from the student at a later date; and

- The institution established the start date of the approved LOA as the first date the student was unable to attend.

If approved, the official Leave will extend the contract period by the same number of days designated in the leave document or actually used by the student. No additional charges will be assessed as a result of an LOA. A student granted an LOA in accordance with this policy is not considered to have withdrawn and no refund calculation is required at this time.

The Leave of Absence and any additional approved leaves of absence may not exceed a total of 180 days in any 12 month period. For federal aid recipients, the student’s payment period is suspended during the LOA and no federal financial aid will be disbursed to students while on a Leave of Absence. Upon the student’s return, the student will resume the same payment period and coursework and will not be eligible for additional Title IV aid until the payment period has been completed. If the student is a Title IV loan recipient, the student will be informed of the effects that the student’s failure to return from a leave may have on the student’s loan repayment terms, including the expiration of the student’s grace period. All approved leaves will be scheduled to begin on the first-class day after the student’s last physical day of attendance prior to beginning the Leave and end on the “Scheduled Return Date”. A contract addendum will be completed and signed by all parties upon return from the LOA to extend the ending date by the applicable number of days.

A student will be withdrawn if the student takes an unapproved LOA or does not return by the expiration of an approved LOA and the student’s withdrawal date for the purpose of calculating a refund will be the student’s last date of attendance.

Student Grievance Policy And Procedures

In accordance with the institution’s mission statement, the school will make every attempt to resolve any student complaint that is not frivolous or without merit. If a student has a complaint, the program Instructor should be made aware and given the opportunity to address the concern or issue. If a student has a disagreement with the Instructor or the Instructor has not resolved the issue, the student should follow the specific steps of the complaint process.

- The student should register the complaint in writing on the designated form provided by the institution within 60 days of the date that the act which is the subject of the grievance occurred.

- The complaint form will be given to the school Director/Faculty Coordinator.

- The complaint will be reviewed by management and a response will be sent in writing to the student within 30 days of receiving the complaint. The initial response may not provide for final resolution of the problem but will notify the student of continued investigation and/or actions being taken regarding the complaint.

- If the complaint is of such nature that it cannot be resolved by the management, it will be referred to an appropriate agency if applicable.

- Depending on the extent and nature of the complaint, interviews with appropriate staff and other students may be necessary to reach a final resolution of the complaint.

- In cases of extreme conflict, it may be necessary to conduct an informal hearing regarding the complaint. If necessary, management will appoint a hearing committee consisting of one member selected by the school who has had no involvement in the dispute and who may also be a corporate officer, another member who may not be related to the student filing the complaint or another student in the school, and another member who may not be employed by the school or related to the school owners. The hearing will occur within 90 days of committee appointment. The hearing will be informal with the student presenting his/her case followed by the school’s response. The hearing committee will be allowed to ask questions of all involved parties. Within 15 days of the hearing, the committee will prepare a report summarizing each witness’ testimony and a recommended resolution

for the dispute. School management shall consider the report and either accept, reject, or modify the recommendations of the committee. Corporate management shall consider the report and either accept, reject, or modify the recommendations of the committee. - Students must exhaust the institution’s internal complaint process before submitting the complaint to the school’s accrediting agency, if applicable. The written request must be sent to:

- Department of Professional and Occupational Regulation (DPOR) Commonwealth of Virginia

9960 Mayland Drive, Suite 400 Richmond, Virginia 23233 (804) 367-8500

http://www.dpor.virginia.gov - State Council for Higher Education in Virginia

101 N. 14th Street, 9th Floor James Monroe Building Richmond, VA 23219 (804) 225-2600

http://www.schev.edu - National Accrediting Commission of Career Arts and Sciences (NACCAS)

3015 Colvin Street Alexandria, VA 22314 (703) 600-7600

http://naccas.org

The student will not be subject to unfair treatment or adverse actions by the school as a result of initiating a complaint proceeding.